Wells Fargo Home Mortgage on 3476 Stateview Blvd in Fort Mill, SC

Welcome to Wells Fargo Home Mortgage (Banks) on 3476 Stateview Blvd in Fort Mill, South Carolina. This bank is listed on Bank Map under Banks - All - Banks. You can reach us on phone number (803) 396-7848, fax number or email address . Our office is located on 3476 Stateview Blvd, Fort Mill, SC.

Popular links

Wells Fargo Home Mortgage Branch Overview

Available accounts

CDs

Checking

Credit Cards

Debit Cards

Gift Cards

Health Savings Account (HSAs)

IRAs

Savings

Contact details

Address

Wells Fargo Home Mortgage

3476 Stateview Blvd, Fort Mill

29715 SC, USA

Call Us

(803) 396-7848

For full contact details (including navigation data) to this bank have a look at the the column to your right (or scroll if you're viewing this on a mobile device.)

Articles Recommended for You

5 Finance Tricks Every Twenty-Something Should Know

There is a lot to worry about once you graduate college with your new degree. Still, personal finance and investing in particular should be a priority. By getting a head start with proper money management, you can greatly increase later returns. Here are our 5 tricks to maximizing your investments!

How to Make Money in Real Estate

Getting started in real estate investing can be expensive, but lucrative. Review our investment and financing strategies to learn how you can get started.

The Real Issue with Obama’s 529 Plan

In his State of the Union address, President Obama made "middle-class economics" his theme. One proposal that emerged from the evening was a new way to handle 529 college savings plans and Coverdell Education Savings Accounts: remove the favorable tax treatment each receives. Here's why there's reason to believe the president's plan is misguided.

Other banks near 3476 Stateview Blvd

Bb and T on 160 Highway (3.6 miles away)

Carolina First Bank on 100 Stone Village Dr (3.6 miles away)

Patel- Alpesh J on 2848 S Carolina 160 (3.6 miles away)

Bank Of America on 115 Tom Hall St (6.9 miles away)

Carolina First Bank on 8179 Charlotte Hwy (7.8 miles away)

Bank of America ATM on 240 Carowinds Blvd (10.2 miles away)

Bank of York on 280 Hands Mill Hwy (12.5 miles away)

Harrington Dennis W on 1920 India Hook Rd (12.5 miles away)

Bank Of America on 2300 Cherry Rd (12.5 miles away)

Bank Of America on 735 Cherry Rd (12.5 miles away)

Wachovia Bank on 742 Cherry Rd (15.1 miles away)

Carolina First Bank on 315 E Main St (15.1 miles away)

Bank Of America on 1165 Cherry Rd (15.1 miles away)

Arthur State Bank on 2015 S Herlong Ave (15.1 miles away)

Bank of America on 1952 Springsteen Rd (15.1 miles away)

Bank Of America on 1274 E Main St (15.1 miles away)

Wachovia on 4100 Charlotte Hwy (17.7 miles away)

Bank Of America on 4090 Charlotte Hwy (17.7 miles away)

Atm USA LLC on 4850 Charlotte Hwy (17.7 miles away)

Killen- James T on 164 Hwy 274 (17.7 miles away)

This Wells Fargo Home Mortgage is located nearby...

Not sure where Wells Fargo Home Mortgage on 3476 Stateview Blvd is? The following places (sorted by popularity) are located nearby. We've also included the estimated walking distance.

Carowinds (0.71 miles away / 14 min walk)Carowinds Boomerang Bay (0.88 miles away / 18 min walk)

Cracker Barrel Old Country Store (0.40 miles away / 8 min walk)

Carowinds~Planet Snoopy (0.65 miles away / 13 min walk)

South Carolina Welcome Center (1.23 miles away / 25 min walk)

Cabelas At Carowinds (0.29 miles away / 6 min walk)

Carrowinds Theme Park (1.11 miles away / 22 min walk)

Carmella's (1.20 miles away / 24 min walk)

Culver's (0.27 miles away / 5 min walk)

NC/SC State Line (0.16 miles away / 3 min walk)

Corporate overview

Wells Fargo operate bank branches in 41 US states (along with online banking available for customers in all states.) Wells Fargo was funded in 1852 and had 6,289 branches and 230,000 employees last year. Wells Fargo is one of the largest banks in The United States (2nd largest bank in deposits, home mortgage servicing, and debit cards.) It's also the 23rd largest company in the United States. The headquarter is located in sioux falls, South Dakota,

Total employees

230,533

Total branches

231

Total deposits

$1.01 trillion (The total dollar amount of cash deposits held by Wells Fargo end of last financial quarter.)

Total loans

$778 billion (The total dollar amount of loans held by Wells Fargo end of last financial quarter.)

FDIC

3511

Year founded

1852

Financial Strength

Texas Ratio

29.59%

Deposit Growth

0.081%

Core Capitalization Ratio

8.86%

Wells Fargo Financial Statement

| TOTAL ASSETS | $1,284,538,000 |

| Cash and Due from Depository Accounts | $137,155,000 |

| Interest-Bearing Balances | $119,728,000 |

| Securities | $217,652,000 |

| Federal Funds Sold and Reverse Repurchase Agreements | $24,894,000 |

| Net Loans and Leases | $764,011,000 |

| Total Loans | $777,820,000 |

| Loan Loss Allowance | ($13,809,000) |

| Trading Account Assets | $32,173,000 |

| Bank Premises and Fixed Assets | $7,595,000 |

| Other Real Estate Owned | $3,068,000 |

| Goodwill and Other Intangibles | $43,391,000 |

| All Other Assets | $54,677,000 |

| TOTAL LIABILITIES | $1,145,682,000 |

| Total Deposits | $1,011,644,000 |

| Interest-Bearing Deposits | $763,046,000 |

| Deposits Held in Domestic Offices | $924,162,000 |

| % Insured | 56.94% |

| Federal Funds Purchased and Repurchase Agreements | $27,862,000 |

| Trading Liabilities | $17,166,000 |

| Other Borrowed Funds | $35,971,000 |

| Subordinated Debt | $19,943,000 |

| All Other Liabilities | $33,096,000 |

| TOTAL EQUITY | $138,856,000 |

| Total Bank Equity Capital | $137,808,000 |

| Perpetual Preferred Stock | $0 |

| Common Stock | $519,000 |

| Surplus | $102,952,000 |

| Undivided Profits | $34,337,000 |

| Noncontrolling Interests in Consolidated Subsidiaries | $1,048,000 |

| INCOME AND EXPENSE | |

| Net Interest Income | $19,491,000 |

| Total Interest Income | $20,803,000 |

| Total Interest Expense | ($1,312,000) |

| Provision For Loan and Lease Losses | ($1,768,000) |

| Total Noninterest Income | $15,033,000 |

| Fiduciary Activities | $845,000 |

| Service Charges on Deposit Accounts | $2,492,000 |

| Trading Account Gains and Fees | $1,459,000 |

| Additional Noninterest Income | $10,237,000 |

| Total Noninterest Expense | ($18,769,000) |

| Salaries and Employee Benefits | ($10,988,000) |

| Premises and Equipment Expense | ($2,105,000) |

| Additional Noninterest Expense | ($5,676,000) |

| Pre-Tax Net Operating Income | $13,987,000 |

| Securities Gains (Losses) | $-20,000 |

| Applicable Income Taxes | $4,528,000 |

| Income Before Extraordinary Items | $9,439,000 |

| Extraordinary Gains - Net | $0 |

| Net Income Attributable to Bank | $9,306,000 |

| Net Income Attributable to Noncontrolling Interests | $133,000 |

| Net Income Attributable to Bank and Noncontrolling Interests | $9,439,000 |

| Net Charge-Offs | $2,107,000 |

| Cash Dividends | $2,500,000 |

| Sale, Conversion, Retirement of Capital Stock, Net | $0 |

| Net Operating Income | $9,452,600 |

| PERFORMANCE AND CONDITION RATIOS | |

| Performance Ratios (%, Annualized) | |

| Yield on Earning Assets | 3.69% |

| Cost of Funding Earning Assets | 0.23% |

| Net Interest Margin | 3.46% |

| Noninterest Income to Average Assets | 2.36% |

| Noninterest Expense to Average Assets | 2.95% |

| Net Operating Income to Assets | 1.48% |

| Return on Assets (ROA) | 1.46% |

| Pretax Return on Assets | 2.17% |

| Return on Equity | 13.67% |

| Retained Earnings to Average Equity (YTD only) | 9.99% |

| Net Charge-offs to Loans | 0.54% |

| Credit Loss Provision to Net Charge-offs | 83.91% |

| Earnings Coverage of Net Loans Charge-Offs | 7.48(x) |

| Efficiency Ratio | 52.29% |

| Assets per employee ($ millions) | $5.572 |

| Cash Dividends to Net Income (YTD only) | 26.86% |

| Condition Ratios (%) | |

| Loss Allowance to Loans | 1.78% |

| Loss Allowance to Noncurrent Loans | 32.65% |

| Noncurrent Assets Plus Other Real Estate Owned to Assets | 3.54% |

| Noncurrent Loans to Loans | 5.44% |

| Net Loans and Lease to Deposits | 75.51% |

| Net Loans and Leases to Core Deposits | 87.33% |

| Equity Capital to Assets | 10.73% |

| Core Capital Ratio | 8.86% |

| Tier 1 Risk-based Capital Ratio | 10.83% |

| Total Risk-based Capital Ratio | 13.48% |

| OTHER KEY FIGURES | |

| Asset-Side | |

| Average Assets | $1,274,094,333 |

| Average Earning Assets | $1,126,233,667 |

| Average Loans | $777,280,000 |

| Noncurrent Loans and Leases | $42,289,000 |

| Noncurrent Loans that are Wholly or Partially Guaranteed by the U.S. Government | $21,354,000 |

| Income Earned, Not Collected on Loans | $4,607,000 |

| Earning Assets | $1,138,150,000 |

| Long-Term Assets (5+ Years) | $370,700,000 |

| Average Assets, YTD | $1,274,094,333 |

| Average Assets, 2 Year | $1,278,079,000 |

| Total Risk Weighted Assets | $1,012,290,100 |

| Adjusted Average Assets for Leverage Capital Purposes | $1,236,866,000 |

| Life Insurance Assets | $17,749,000 |

| General Account Life Insurance Assets | $4,450,000 |

| Separate Account Life Insurance Assets | $12,764,000 |

| Hybrid Account Life Insurance Assets | $535,000 |

| Insider Loans | $85,551 |

| Loans and Leases Held For Sale | $23,419,000 |

| Liability-Side | |

| Volatile Liabilities | $134,606,000 |

| FHLB Advances | $203,000 |

| Unused Loan Commitments | $370,931,000 |

| Total Unused Commitments | $370,931,000 |

| Equity-Side | |

| Average Equity | $136,201,666 |

| Tier 1 (core) Risk-Based Capital | $109,630,000 |

| Tier 2 Risk-Based Capital | $26,904,000 |

| Derivatives | $2,147,483,647 |

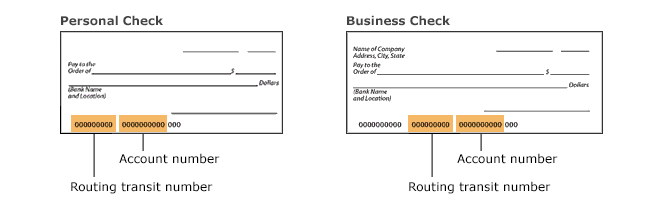

Routing numbers

Wells Fargo Home Mortgage Fort Mill routing numbers are listed on this site along with more information about how to find your routing number. Call Wells Fargo Home Mortgage for more information about routing numbers.

Routing numbers to Wells Fargo Home Mortgage in Fort Mill are collected manually from the banks official website or provided by the Federal Reserve Financial Services Database.

Also known as banking routing numbers, routing transit numbers, RTNs, and SWIFT codes. Routing numbers are different from checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers.

Looking for your account number? Review your account statement or visit a Wells Fargo banking location.

Checking/savings/money Market Accounts

You can find your nine digit routing number on the lower left corner of checks. (Keep in mind that the routing number is based on where you first opened your account.)

For wire transfers, use the routing number 121000248 for domestic wires and the SWIFT code WFBIUS6S for international wires.

Did you open your account online or by phone? Please refer to your checks or call 24/7 at 1-800-TO-WELLS (1-800-869-3557).

Alabama 62000080Alaska 125200057

Arizona 122105278

Arkansas 111900659

California 121042882

Colorado 102000076

Connecticut 21101108

Delaware 31100869

District of Columbia 54001220

Florida 63107513

Georgia 61000227

Hawaii 121042882

Idaho 124103799

Illinois 71101307

Indiana 74900275

Iowa 73000228

Kansas 101089292

Kentucky 121042882

Louisiana 121042882

Maine 121042882

Maryland 55003201

Massachusetts 121042882

Michigan 91101455

Minnesota 91000019

Mississippi 62203751

Missouri 121042882

Montana 92905278

Nebraska 104000058

Nevada 321270742

New Hampshire 121042882

New Jersey 21200025

New Mexico 107002192

New York 26012881

North Carolina 53000219

North Dakota 91300010

Ohio 41215537

Oklahoma 121042882

Oregon 123006800

Pennsylvania 31000503

Rhode Island 121042882

South Carolina 53207766

South Dakota 91400046

Tennessee 64003768

Texas 111900659

Texas - El Paso 112000066

Utah 124002971

Vermont 121042882

Virginia 51400549

Washington 125008547

West Virginia 121042882

Wisconsin 75911988

Wyoming 102301092

American Samoa 121042882

North Mariana Islands 121042882

Puerto Rico 121042882

Virgin Islands 121042882

American Forces Abroad 121042882

Job Openings

Open positions for Wells Fargo Home Mortgage in Fort Mill.

Consumer Complaint Stats

| Product / Complaint category | Complaints in 2013 |

|---|---|

| Mortgage | 100 |

| Bank account or service | 49 |

| Credit card | 5 |

| Consumer loan | 4 |

| Student loan | 3 |

| Debt collection | 1 |

Wells Fargo Home Mortgage Consumer Complaints (South Carolina, 2013)

Average ratio for Wells Fargo Home Mortgage: 12.77 complaints per branch.These numbers are gathered from the CFPB (Consumer Financial Protection Bureau) to give you a transparent overview of complaints Wells Fargo Home Mortgage in South Carolina received in 2013.

Having problems with your bank? File a bank account or service complaint here.

Wells Fargo Home Mortgage Bank Hours (Business hours)

These are the bank hours for Wells Fargo Home Mortgage. Call (803) 396-7848 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Monday 9:00 am - 6:00 pm

Tuesday 9:00 am - 6:00 pm

Wednesday 9:00 am - 6:00 pm

Thursday 9:00 am - 6:00 pm

Friday 9:00 am - 6:00 pm

Saturday 10:00 am - 4:00 pm

Sunday closed

Fees, interest rates and costs

There's currently no additional information available about fees or rates for Wells Fargo Home Mortgage.

Ask a question or leave a comment

We'd love to hear about your experience. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in your city.28 Comments, Questions or Reviews - Add

Mark Hood asked a question

Hello,

I would like to make an appointment with a representative from your bank to talk about the following foreclosed property:

10013 Michelle LP NE 87111

Parcel ID: 1 021 061 090 450 21824

Thank you.

Yvonne Hayess asked a question

Hello,

I am a Realtor in Lancaster, CA. You have property at 9325 Rea Avenue, in California City, CA 93505-4849. I have a buyer that is interested in it. Could you refer me to the Realtor that you have assigned this property to. My number is 661-860-8444 and my email is c21yhayes@yahoo.com. Thank you for your cooperation.

Yvonne Hayes

Vicki Wysocki wrote something

Hi I am interested in a piece of property, address is 814 W. 6th street Grand Island, Nebraska 68801 - not sure if you are the one that has the property, I just know the bank is in fort mill, sc 29715

Written August 2014 on a Tuesday (2014-08-12)Linda Wilson asked a question

i am interested in finding out about when you are going to list the foreclosed property located at 19915 Mahogany Street in Bend Or 97702. I would like to put in an offer on it.

Written March 2015 on a Sunday (2015-03-08)Bobby Jardine asked a question

I am interested in purchasing one of your foreclosed properties. The address is 2509 West 4985 South, Taylorsville, Ut 84118. Please send information to bjardinecwp@hotmail.com. Thank you.

Written March 2015 on a Wednesday (2015-03-25)Susie Baker asked a question

I am interested in purchasing one of your foreclosed properties. The address is 6812 Landor Ln, Springfield, VA 22152. Please send information to susiebaker@hotmail.com. Thank you.

Written November 2014 on a Monday (2014-11-24)cindy hayden asked a question

I believe you own a home at 212 Summerset Lane, Summerville ,SC .

I am interested in buying ,I would appreciate any information or guidance from you that can help me with the purchase of this property. thank you Cindy 843 323 6520

Elaine Vallin asked a question

I believe you own the foreclosed property at 170 Heron Dr., Melbourne Beach, FL 32951. I would like more info about that property, please.

Written October 2014 on a Sunday (2014-10-26)Latoya Christian asked a question

I have a few question about the property at 2314 Nolan Dr in flint Michigan can some please contact me at 810 9383812 thank you

Written January 2015 on a Tuesday (2015-01-27)Margaret D. Wood asked a question

I have completed a bakruptcy. I need know the status and balance of my account with you

sshawn asked a question

I received a check from farmers bank the remitter is christopher emory authorization is rebeca cole preston I received it from a friend is this a scam???

Written October 2014 on a Monday (2014-10-27)Scott McLaughlin asked a question

I see that your bank owns a home listed at 10 Fairview avenue in Darien CT. Its been foreclosed. I am looking for the correct contact person to inquire on the property. I can be reached at scott.mclaughlin@gmail.com or 917-734-9446.

Scott

pablo ramirez asked a question

I want to buy the following foreclosed property, 155 west main st Glen Lyon, PA 18617. Please email me back at camposcity@hotmail.com or call 347 234 4317. Thanks!

Written November 2014 on a Sunday (2014-11-23)Tommy Mack asked a question

I would like to buy one of the foreclosed properties you own. 8478 Rugby Rd Pasadena MD 21122

Written November 2014 on a Tuesday (2014-11-04)Lillian Morgan asked a question

I would like to know the agent handling the property at 2842 Sebring Road, Philadelphia. PA 19152

Written February 2015 on a Monday (2015-02-02)Rhonda F. Underwood asked a question

I would like to purchase 5208 Larkspur Dr. in Winston-Salem NC. Looking for single family foreclosures. (e-mail) RUNDERWOOD15@triad.rr.com Thank You.

Doreen West wrote something

I would like to talk to a representative about a foreclosed property here in Florida.

6472 Abdella Lane, North Port, FL 34291

Parcel ID# 0945010822

LOT 22, BLK 8, NORTH PORT CHARLOTTE ESTATES 1ST ADD, CONTAINING 3.05 Ac+/-.

If you would call me at 941-628-9640 or by email at doreenmdwest@aol.com to discuss further. The property has been abandoned and has unidentified people living there. Thank you

Mark Wallek asked a question

Is it on purpose that it is impossible to reach anyone at the listed phone number?

Written April 2015 on a Wednesday (2015-04-29)Mark Wallek added information

On Property ID : 09-029-24-31-0184. 2930 Knox N. Minneapolis 55411. As I told you earlier, the rental tenants at 2926 Knox N are continuously trespassing onto 2930 Knox by parking in the driveway. Well now they are damaging the gated fence with their sloppy style, just as they ruined the gates on the sloplords' property. The landlord of 2926 is Antonio Holliday. His number is 612-272-7274. He is the sort of sloplord we do not want to see getting another house in this neighborhood. Please do something about this as we resident owners ARE FIGHTING TO PRESERVE LIVABILITY.

Written April 2015 on a Wednesday (2015-04-29)Montgomery Borough Codes Department asked a question

On September 29, 2014 a letter was sent to your office Certified concerning the property located at 104 Broad Street, Montgomery, PA. The letter was a letter of condemnation for this property. I have not heard from anyone in your office concerning this property and I am inquiring what your plans are with this property. Please contact me as soon as possible at 570-547-6919. Thank you, Walter J. Bohner, Building Code Official, Borough of Montgomery.

Written October 2014 on a Tuesday (2014-10-14)Tommy Mack asked a question

Please email me about foreclosed property tmack234@gmail.com

Written November 2014 on a Tuesday (2014-11-04)Mark Wallek added information

Regarding property id 09-029-24-31-0184 AT 2930 Knox N in Minneapolis, MN. Please know that this house is in a neighborhood of single family homes now devastated by absentee landlords and section 8 rentals to the continuing detriment of resident owners who all invest in their properties. Trying to keep the neighborhood livable means having residents who care, and renters who want to be in the neighborhood, not just occupy a deteriorating property until they move to the next. Myself, and other resident owners are begging you to please do not let this family home become yet another rental property and further deteriorate my neighborhood. I have tended this property as it sits vacant, repairing a window on the garage broken by the occupants of the rental just to the south of 2930. I've chased semi feral children off the garage roof at 2930 as they were managing to damage the roof and the roof of their own rental just to the north. I have continuously closed the gates, but there is nothing legally I can do to have the car towed that illegally uses the driveway at 2930 as their own. Please have them towed as their encroachment behavior is part of the deterioration of the neighborhood. Think of the good you can do by selling this sweet little property to a real psychologically healthy individual who wants to live in it. Contact me at 612-522-4638 if I can be any help.

Written April 2015 on a Saturday (2015-04-25)Mark Wallek posted a comment

Thanks for nothing. This site is clearly bogus. One wonders just what sort of scam you have going. After The Mortgage department sent me all my confidential information IN AN UNSEALED ENVELOPE, I wonder what other dysfunction plagues your operations. Since I'll be getting no response I guess I really should not care too much.

Written May 2015 on a Tuesday (2015-05-05)Bob Smith asked a question

The property located at 2302 Lashi St SE Olympia, WA. 98513, is or is being foreclosed on. This property backs the Nisqually Reservation. The Tribe would like to purchase this and place the property into the housing stock and rent the property to a Tribal member. We would be happy to take the home at a fair price with all the damage. We already own four homes on three sides of this one, therefore the property would fit with our program. Thank you Bob Smith Housing Director, Nisqually Tribe

Written September 2014 on a Thursday (2014-09-04)Jill Mathis asked a question

who is my contact for property that was foreclosed and owned by your bank located on Hubert Martin Road Cumming Georgia property is land only.

Written January 2015 on a Thursday (2015-01-08)Phyo Win asked a question

Would like to know when will be available in market for a property of 5 Maria Ln, Smyrna, DE 19977! Interested to buy.

Written August 2014 on a Sunday (2014-08-17)Gene Svoboda asked a question

You foreclosed on a property located at 720 7th Street Sealy, Austin County, TX 77474 on February 03, 2015. I am interested in possibly in purchasing this property. Please contact me at 979-885-6250 or gsvoboda@sbcglobal.net

Written March 2015 on a Monday (2015-03-02)Jerry Wells, Wells Realty, Imboden, AR 72434 office phone 870-869-2412 asked a question

You have a property being foreclosed on or being foreclosed on Bradford Rd. Ravenden, AR. 72434

Please let me know about this property as I have someone interested in purchasing it. wellsrealty@centurytel.net or office 870-869-2412

Share your experience

We'd love to hear about your experience with Wells Fargo Home Mortgage. Did you suffer through long waiting times, unprofessional staff or high fees or were you treated with great customer service, the business hours you were expecting and a great overall experience? This is your chance to share your thoughts about this branch and help other consumers get the best banking experience in Fort Mill.Address

Bank location

Bank address

Wells Fargo Home Mortgage 3476 Stateview BlvdFort Mill, SC 29715

Navigation data

Area Code: 803Latitude: 35.0951096

Longitude: -80.9315019

County: York

FIPS county code: 45091 Ask question Write review

External resources

ATM locator

Routing Numbers

Official website

Business hours

Wells Fargo Home Mortgage Bank Hours (Business hours)

These are the bank hours for Wells Fargo Home Mortgage. Call (803) 396-7848 to learn more about office hours. Please note that these bank hours are general and other hours of operation may apply on certain holidays.

Monday 9:00 am - 6:00 pm

Tuesday 9:00 am - 6:00 pm

Wednesday 9:00 am - 6:00 pm

Thursday 9:00 am - 6:00 pm

Friday 9:00 am - 6:00 pm

Saturday 10:00 am - 4:00 pm

Sunday closed

Phone

Phone: (803) 396-7848

Fax: No listed fax number.

Email address

No listed email address.

Areas of practice

Wells Fargo Home Mortgage is listed under Banks in Fort Mill, South Carolina .

Pro tip Browse Banks & bank offices in Fort Mill, South Carolina by bank issue and category.

wells fargo 3476 stateview blvd hours 3476 stateview blvd wells fargo bank fort mill sc us bank 3476 stateview blvd wells fargo stateview rd, ft mill sc wells fargo bank ft mills sc